A Different Organization

Annual Report 2023

About Us

We are a financial institution which aims to become the best strategic partner for our clients. Grupo Financiero B×+ is comprised of four business units: B×+ Banking, Stock Exchange House, Leasing and Insurance.

We provide simple and tailored solutions for our clients’ financial needs, through a wide array of financial products, designed and executed impeccably.

Our Purpose

To enrich

people´s lives

Our Values

Loyalty + Integrity + Audacity

Message from the Chairman of the Board

of Grupo Financiero B×+

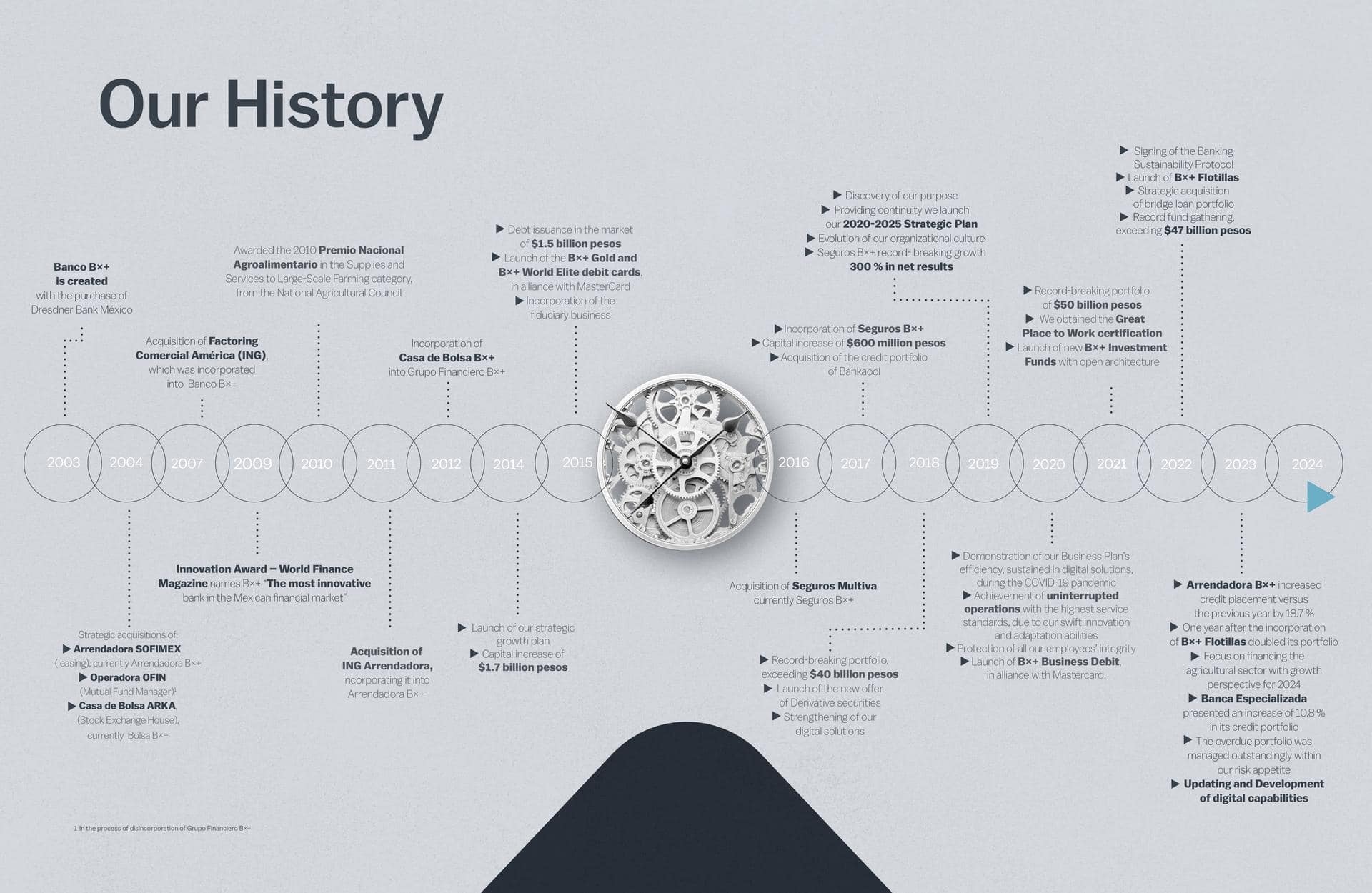

In April 2004 Banco B×+ was opening its first deposit accounts, and in May of that same year it would grant the first loan. Twenty years have passed since the beginning of operations, when a group of investors had a clear project to create a different bank, with a unique business model, offering high returns to depositors and speed and efficiency to borrowers, with a clean infrastructure, without the burdens of traditional banks. All of this was in keeping with a name that broke with the usual banking nomenclature.

Over the last two decades we have evolved. Capitalizing on the generation of critical mass, we have been introducing more and better products and services, increasing transactionality and customer loyalty, reducing our costs, improving profitability and always taking care of the soundness of our balance sheet and the health of our loan portfolio. While maintaining our competitive advantages, we have grown together with our customers, and those projects we have supported are now a reality.

Today we have a solid transactional offer, consolidating our competitiveness and profitability. We are growing a client base that is better linked, supported by a very close business relationship.

In 2023, we overcame different challenges. From the economic point of view, we saw a recovery in our country’s growth levels accompanied by a stable exchange rate. The global and regional macroeconomic environment reflects great opportunities for our country; however, there are two factors to which we must continue to pay attention: inflation and high interest rates.

The political environment continues to generate noise and it is increasing. Although the electoral race has already begun, we must be cautious and not be distracted from what is important, taking advantage of the opportunities that this juncture offers us.

At B×+ we remained focused, aligned to move forward with the 2020 – 2025 Strategic Plan; this is reflected in the fact that we are more efficient, generating value for clients, collaborators and shareholders.

My appreciation to those who are part of this great organization; together we have achieved very important growth and have positioned ourselves as a strategic player in the sector.

Twenty years later, I am proud to see that not only did we manage to create a different bank, but also a different organization. Jaime Ruíz Sacristán would be very proud of his legacy. Let us celebrate these first two decades in honor of his memory.

We are ready for the next chapters, hand in hand with our purpose and values. We want to keep moving forward, consolidating ourselves to continue growing, meeting increasingly ambitious goals, those that a different organization is capable, not only of achieving, but of surpassing.

Reach Further!

Antonio del Valle Perochena

Chairman of the Board of Directors Grupo Financiero B×+

Message from the Chief Executive Officer

of Grupo Financiero B×+

The country’s macroeconomic conditions were surprisingly solid during the year. Economic activity would have expanded 3.3 %, driven by strong growth in investment and the steady advance in private consumption. However, inflation remained relatively high; in response, Banco de México decided to maintain the benchmark interest rate at 11.25%, thus contributing to the strength of the Mexican peso.

On the international front, the U.S. economy also exhibited resilience and strength in employment, while inflation - despite moderating - remained far from the FED’s target. In response to this, the U.S. central bank raised the federal funds target to the 5.25 - 5.50 % range.

The Regrouping of global supply chains is a phenomenon we have been following closely. The investments in the country associated with this element seem to be materializing as Mexico looks to increase its participation in the U.S. market.

Against this backdrop, at Grupo Financiero B×+ we set ourselves the task of finding opportunities to achieve satisfactory results, maintaining the sustained growth we have achieved since our founding 20 years ago.

We maintain the four strategic elements we set out in 2022: first, to focus on our customers, seeking to satisfy their comprehensive financial needs, strengthening our business relationship; second, to increase our active customer base to drive the growth of Grupo Financiero B×+; third, to continue to monitor our past-due portfolio to generate adequate levels of capitalization, solvency and liquidity; and fourth, operating efficiency.

In 2023, credit in the large corporate segment grew by more than $4.4 billion MXN; on the other hand, we are exiting non-strategic portfolios. We also concluded the purging and refocusing of credit to the agricultural sector and we are ready to return to growth in 2024.

Special mention should be made of the good management of the past-due portfolio, where in addition to avoiding new entries, we were able to remove others through the execution of guarantees and other instruments. With this we met one of the main challenges of the year. We will continue working to maintain the delinquency rate in line with our risk appetite, while taking care of our portfolio generation.

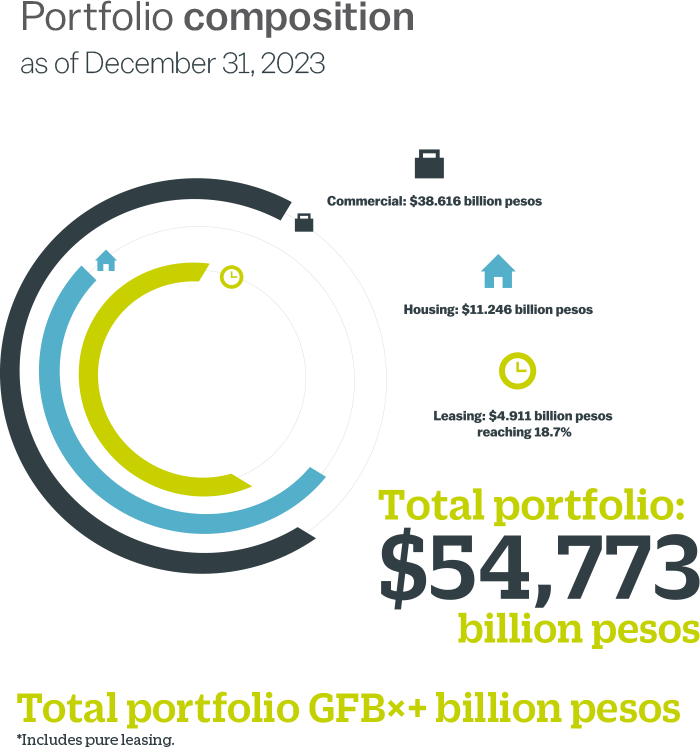

2023 was an extraordinary year for Arrendadora B×+: New business placements grew 33.6 % to 2.857 billion MXN, leading to an 18.7 % increase in the total portfolio to 4.911 billion MXN. In line with the rest of Grupo Financiero B×+, the delinquency rate was reduced to 2.08 %.

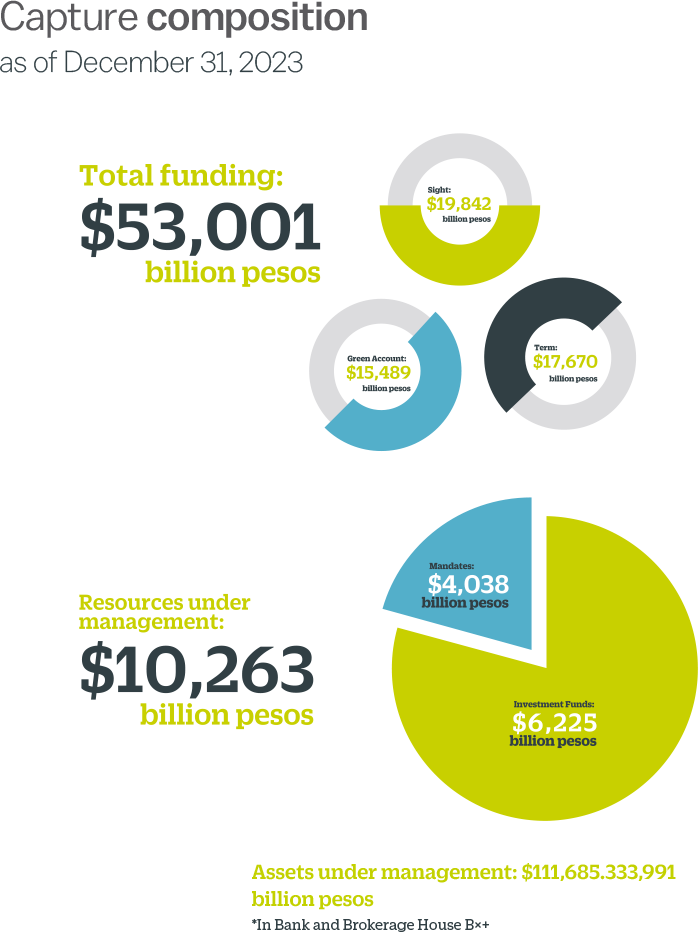

In analyzing deposits, we were able to increase total deposits to 53.001 billion MXN, which represents an increase of 10.8% and a gain in market share. This translates into an increase in self-funding, improving the cost, lowering 60 basis points against the TIIE.

Seguros B×+ increased premium issuance, mainly in individual major medical expenses and auto, thanks to the closeness maintained by the commercial team with our extensive sales force.

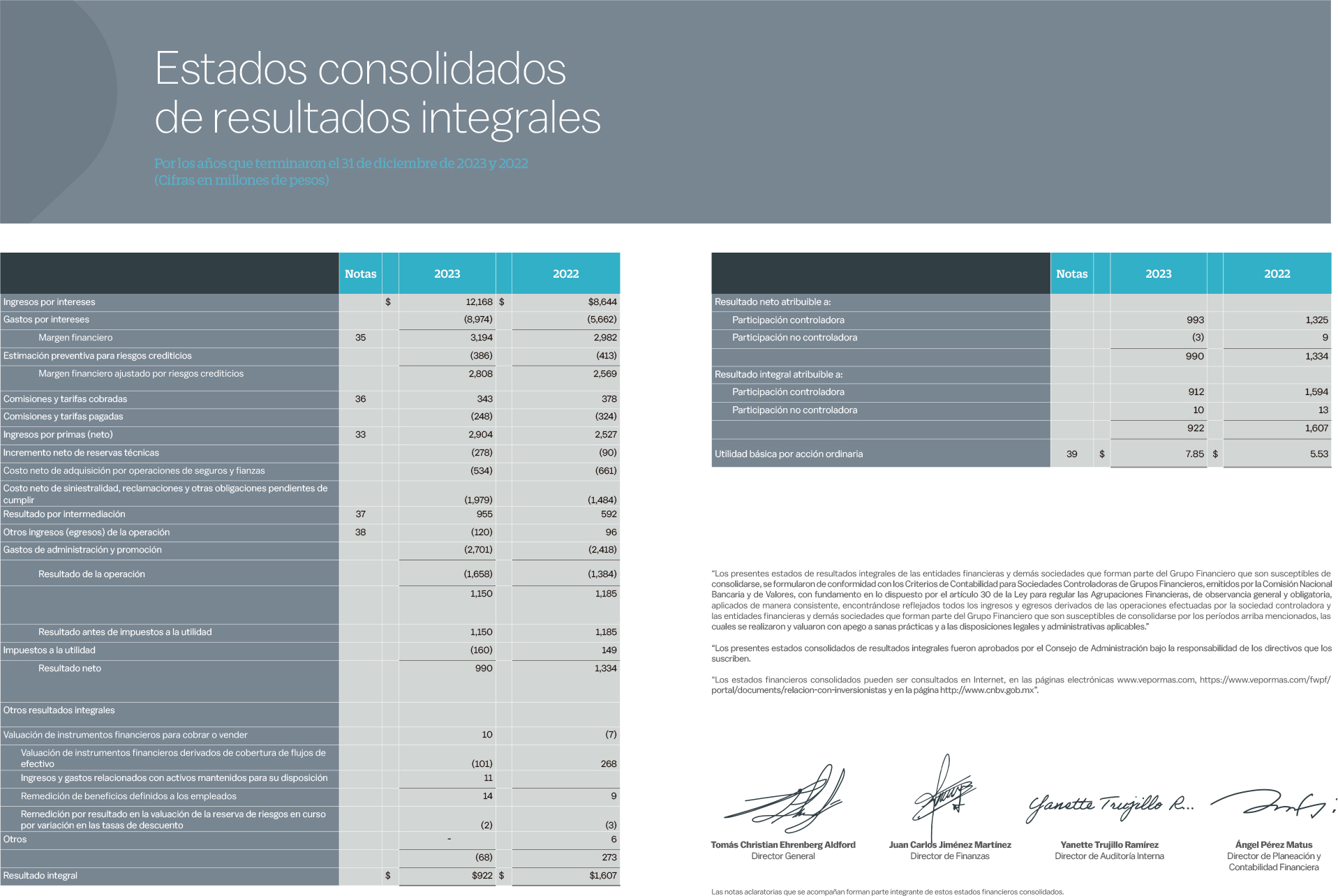

As a result, Grupo Financiero B×+ ended the year with an increase in revenues, from 3.474 to 3.906 billion MXN, equivalent to an increase of 12.4 %, and a better pre-tax profit, closing the year at 1.227 million MXN.

To achieve these results, we continued to promote a performance culture with dialogues between leaders and employees that allow us to align, reorient, and adjust B×+ activities.

A very relevant factor was the upgrade of the central banking operating system. This process will significantly boost transactionality and reinforces the digitalization strategy of the processes and solutions we offer our clients. This and other investments put us on the right track to continue on the right path to enhance our growth.

At Grupo Financiero B×+ we are increasingly living our purpose: to enrich people’s lives. This year we made considerable progress with the Sustainability Committee that will help us focus all our activities to align with the 2030 sustainable agenda.

2024 will be a very special year for all of us at Grupo Financiero B×+. We are celebrating 20 years since our first operation and I can affirm that we are a different organization that is positioning itself as a benchmark in the Mexican financial system.

Reach Further!

Tomás Ehrenberg Aldford

Chief Executive Officer of Grupo Financiero B×+

Relevant

Events

HR Ratings changed its outlook to positive for Banco, Casa de Bolsa and Arrendadora B×+. Bolsa and Arrendadora B×+; while Fitch Ratings maintained the ratings of all four subsidiaries

Updating of the central banking operating system

Formalization of the Sustainability Committee as the highest decision-making body for the incorporation of the sustainable agenda

Great Place To Work certification was renewed

Strategic Plan

2020 - 2025

During 2023, in order to steadily advance towards the fulfillment of the 2020 - 2025 Strategic Plan, we decided to follow up on key indicators that demonstrate our solidity, capitalization, liquidity and delinquency rates.

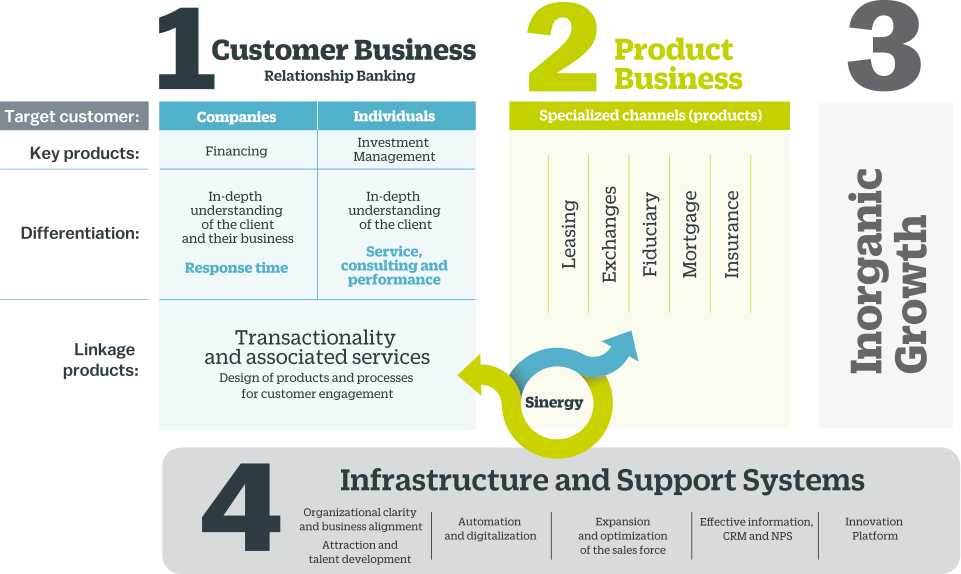

In the Strategic Plan, B×+ has embodied the business model with which we have successfully competed and will be a driving force for the years to come. It has been designed taking into account the differentiation and specialization of products and services, as well as the four pillars that support the model, giving cohesion to all strategic areas.

In addition to the above, we focus on four fundamental points: the first is to grow income by generating new business and attracting new customers. Secondly, activating customers, seeking to increase their transactionality.

Third, to adequately manage expenses, which we achieved very efficiently during the year, and fourth, to control the past-due portfolio, whose management in 2023 was extraordinary.

The follow-up of these actions ensured an adequate execution, resulting in a healthy financial situation for Grupo Financiero B×+.

Three years after the launching of the Strategic Plan, we have demonstrated that we are on the right track and that the business model has allowed us to compete successfully. This will prepare us for the years to come and we will be ready to start developing the next one that will give continuity to our activities.

The competitive advantage of this business model is that it is focused on differentiation and specialization of the commercial offer, centered on four fundamental pillars which give support to the business model, generating unity and synergies in all strategic areas.

The first pillar, Customer Business, focuses on serving companies and individuals, for which we have developed specific objectives: for companies, we offer tools that facilitate their financing and liquidity needs. For individuals, we focus on managing their investments to maximize returns.

In both segments, one of our differentiators is the personalized attention that allows us to become their strategic partners. This is accompanied by a wide range of financial products and services. A key element are the digital solutions that simplify our clients’ operations and which we are increasingly strengthening by incorporating more functionalities and capabilities.

Our second pillar, the Product Business, is made up of specialized channels, operated by five business units: Leasing, Foreign Exchange, Fiduciary, Mortgage and Insurance. Each one is served by a specialized sales force, generating synergies with the other pillars and seeking the closeness that our customers expect.

The third pillar, called Inorganic Growth, seeks to detect opportunities that arise in the market to make strategic acquisitions that consolidate our business model.

The fourth pillar, Infrastructure and Support Services, focuses on key elements that support all other pillars. The first, Human Capital, fosters organizational clarity, commercial alignment, as well as talent attraction and development. The second component enables a greater degree of automation and digitalization of processes. The third aspect promotes efficiency and expansion of our sales force. Fourth, to obtain effective information and its management through CRM and NPS. And finally, to drive a constant innovation platform.

2023:

A Different

Organization

Throughout 2023, important actions were taken that allowed us to sustain the progress of our Strategic Plan 2020 - 2025, accompanied by hard teamwork that led to good results.

One of our success factors, which has become our competitive advantage, is to become strategic partners of our clients in order to be at the right time with the right financial solution to materialize their dreams.

In the area of financing, we have built success stories thanks to our credit offer in different schemes, from simple credit, bridge loans, leasing, factoring or corporate financing, ranging from the simplest to the most sophisticated, depending on the market and the needs of our customers.

Today we finance from houses to boats, adding real estate developments, transportation equipment, as well as accompanying important issues in the Debt Market, to mention a few. All of these are mainly the result of a thorough understanding of the client’s business model, to which we add cost-effective and innovative solutions.

Risk mitigation becomes a premise that allows us to maintain the level of non-performing loans within the limits of our appetite, privileging the liquidity and solvency of B×+. To this end, we are constantly monitoring what we call early alerts to deal with possible defaults in order to seek solutions hand in hand with our borrowers, which has been very successful. Proof of which is the extraordinary management of the past-due portfolio during 2023, which we will maintain in the years to come.

Our deposits advanced significantly, thanks to the excellent B×+ Beneficios and B×+ Empresa accounts, which are gaining market share.

Today we have a higher transaction volume due to the characteristics of both products and the great combination they achieve with Cuenta Verde and Inversión Empresarial B×+ respectively.

By the end of 2023, the transaction volume through the B×+ Gold, B×+ World Elite and B×+ Business Debit Cards will reach more than 750 thousand transactions equivalent to more than $663 million pesos. With the largest ATM network, we recorded considerable increases, reaching $296 million pesos in a little more than 110 thousand transactions.

Although 2023 represented a challenge, we found options in the markets to accompany our clients with options, highlighting the B×+ Derivatives Market and B×+ Debt Market products, in addition to B×+ Mutual Funds and B×+ Mandates; it is essential to highlight the great acceptance of the B×+ Funds family, which have had outstanding returns according to the investment profiles.

It is essential to highlight the great acceptance of the B×+ family of funds, which have had outstanding returns in accordance with the investment profiles. In the stock market, fixed-income instruments gained relevance, which served as a hedge against the economic situation.

One year after we launched B×+ Flotillas, we doubled the value of the portfolio with important plans to keep up the pace. This product reinforces our existing offer, which includes leasing schemes such as pure leasing, finance leasing and leaseback. Arrendadora B×+ achieved outstanding growth, making it a benchmark for the leasing sector in Mexico and a leading competitor.

Seguros B×+ saw a considerable increase in the issuance of policies, with a 24% increase, mainly in the major medical and auto insurance lines, thanks to the joint work with the sales force.

Undoubtedly, digital development is a fundamental pillar of the strategic plan and one of our differentiators. An example of this was the successful migration of the central banking operating system, which offers us greater capacity to develop products and services, in addition to being at the forefront of our competitors. In the following years, we will continue to invest in state-of-the-art technology to maintain our position as a benchmark in the sector.

During this year, we were able to consolidate our reputation in the media, expanding our conversations, where in addition to our leadership in economic, financial and business analysis, in 2023 we strengthened our positioning in terms of financial culture and education.

Important media outlets recognized us as one of Expansión’s 500 Companies, the 1,000 Companies, and the 50 most important banks by Mundo Ejecutivo. These distinctions attest to our reputation.

During this period we were very close to our clients through our B×+ Trends talks in different cities of the country, offering them the most updated information and the latest news that will allow them to better manage their assets and, therefore, make the best decisions.

All of this is a reflection of what we have built together during these 20 years in which we have grown and become a strategic player in Mexico’s financial sector; we have gone from a different bank to a different financial group.

Sustainability

Grupo Financiero B×+ is convinced of the contribution to the communities where we operate and therefore, we seek to reduce the impact, seeking to generate actions that trigger an environmentally friendly and sustainable development. During 2023 we formalized the Sustainability Committee, which is made up of the highest management and level to incorporate the 2030 agenda.

This committee has taken important steps such as the basis for the materiality analysis of Grupo Financiero B×+, the restructuring of risk appetite and credit profile, as well as the incorporation of a SARAS - Environmental and Social Risk Management System - to the credit studies, among others. By the end of 2024 we will have a comprehensive sustainable strategy.

We are proud to renew the Great Place to Work certification in recognition of our efforts to strengthen our organizational culture, the cornerstone of which is our purpose and values.

During this year, we provided more than 45,000 hours of training to reinforce knowledge and skills, which allowed us to strengthen our commercial areas, particularly in service, objection handling and analysis, and were able to obtain different certifications. To all this, we added regulatory and normative topics such as: Risks, Business Continuity, Prevention of Money Laundering and Terrorism Financing, Privacy Treatment of Personal Data, and those granted by the Mexican Association of Stock Market Institutions (AMIB), among others.

Special mention should be made of our commitment to financial culture and education; we are increasingly participating in more spaces where we disseminate valuable information, both in academic activities and in the media. We gave conferences in different forums, including those organized by the Association of Banks of Mexico and the National Guard. As has become a tradition, we were present at the National Financial Education Week, organized by the Association of Banks of Mexico and Condusef (National Commission for the Protection and Defense of Financial Services Users).

In other forums, we actively participated in the 2nd Banking Congress on Financial Education, organized by the Association of Banks of Mexico, as well as in the AMAI (Mexican Association of Investment Advisors) Congress.

Confirming our commitment to transparency and the active fight against corruption, proof of this is the recognition for several consecutive years of appearing in the ranking of Expansión within the 500 companies against corruption; which shows us that we are on the right track, strengthening our corporate governance and incorporating best practices.

As we do every year, at Grupo Financiero B×+, we seek to empower the children of our country, which is why we join the noble causes carried out by Fundación John Langdon Down, Kardias, Fundación Quiera and Bécalos, favoring the little ones in different needs such as education, health or the promotion of children’s dignity.

This is how we have written 20 years of a success story, even though 2023 is our founding anniversary, where we are working to transform ourselves from a different bank to a different organization, with all the services our customers need.

Corporate Governance

Board of Directors

Don Antonio del Valle Ruiz

Chairman Emeritus of the Board

Antonio del Valle Perochena

Chairman of the Board of Directors of Grupo Financiero, Banco, Casa de Bolsa and Arrendadora B×+

Carlos Ruiz Sacristán

María Blanca del Valle Perochena

Francisco del Valle Perochena

Jorge Martínez Madero

Antonio Silva Jáuregui

José Antonio Tricio Haro

Margarita Hugues Vélez

Jorge Ricardo Gutiérrez Muñoz

Guillermo Acedo Romero Rivera1

Rogelio Barrenechea Cuenca1

Francisco Moguel Gloria1

Francisco Quijano Rodríguez1

Secretary

Almaquio Basurto Rosas

Assistants Secretary

Humberto Goycoolea Heredia2

Juan Pablo del Río Benítez2

Jorge Rodríguez Elorduy*

Administration Counsel President

Seguros Bx+

1 Independent Directors

2 Non-members of the Board of Directors

* Not part of the Board of Directors of Grupo Financiero B×+

Steering Committee

Tomás Christian Ehrenberg Aldford3

Chief Executive Officer of Grupo Financiero B×+

Alejandro Finkler Kudler3

Chief Executive Officer Casa de Bolsa B×+

Diego Zarroca Ybarz3

Deputy Director of Banca Comercial y Director General de Arrendadora B×+

María Elisa Medina Salamanca

Chief Executive Officer of Seguros B×+

Adolfo Herrera Pinto3

Deputy Director Commercial Development, IT and Operations

Alfredo Rabell Mañón3

Deputy Director Specialized Banking

Alejandro Rolón Moreno Valle3

Deputy Director Risks

Gustavo César Garmedia Reyes3

Administration and Compliance Director

Yanette Trujillo Ramírez

Audit Director

Nina Gutiérrez Torres3

Human Capital Director

Juan Carlos Jiménez Martínez3

Chief Financial Officer

Humberto Goycoolea Heredia3

Legal Counsel

3Members of the Steering Committee of Grupo Financiero B×+

Audit and Corporate

Practices Committee

This Committee’s structure and the quorum for its sessions adheres to current regulations. The Committee fulfilled its obligation to prepare and report to the Board of Directors on the following:

Regarding Audit Matters:

This report includes, at least: (I) Any shortcomings, discrepancies or aspects of the Internal Control System, which if necessary, require improvement, (II) a mention and follow-up on implementation of preventive and corrective measures taken in response to observations made by the National Banking and Securities Commission and the results of internal audits, as well as those from the Internal Control System assessment performed by the Audit Committee itself, (III) the performance evaluation of the Internal Comptroller’s and Internal Audit area, (IV) the significant aspects of the Internal Control System that might affect the results of the Institution’s activities, (V) an assessment of the Business Continuity Plan’s reach and efficacy, (VI) the performance evaluation of the external auditor, as well as the description and evaluation of additional services or complementary services, if any, provided by the external auditor, (VII) the performance evaluation of the independent actuary that rules on the situation and sufficiency of the technical reserves, as well as the quality of his opinion and reports, (VIII) the main results of the review of the financial statements of the holding company and subsidiaries, as well as the judgement, reports, opinions and communications of the external auditor and the independent actuary, (IX) the follow-up of the agreements of the Shareholders’ Meetings and the Board of Directors, and (X) any deficiencies, deviations or aspects of the Comprehensive Risk Management System, the actuarial function and services contracting with third parties that, where appropriate, require improvement.

Regarding Corporate Practices Matters:

The report includes, at least: (I) the observations regarding the performance of relevant directors, (II) all acts with related persons, detailing any significant characteristics, (III) the packages of emoluments or comprehensive remuneration for individuals, (IV) waivers granted by the Board of Directors, and (V) the observations made by the supervisory commissions.

Executive

Committee

The Executive Committee is appointed by the Board; its function is to address all urgent matters that cannot be delayed until the regularly scheduled meetings of the Board of Directors.

Furthermore, it shall ensure compliance with the resolutions of the Board of Directors, but in no case shall it have powers reserved exclusively by the Bylaws or by law to any other body of the Company.

Comprehensive

Risk Management

Committee

(CADIR)

The CADIR aims to manage all risks our Institution is exposed to and ensure that all operations comply with the appetite for risk, the comprehensive risk management goals, policies, and procedures previously approved by the Board.

Regarding Discretionary Risks, the CADIR approves specific limits to manage risk in the different portfolios, activities and business lines, which are approved by the same body. For the Non-Discretionary, it establishes the tolerance levels. The CRMC also approves methodologies and procedures to identify, measure, oversee, limit, control, inform and disclose the diverse types of risks the Institution is exposed to, all the above according to current regulations.

Ethics and Integrity

Committee

This Committee aims to ensure that all members of Grupo Financiero B×+ reflect and represent the ethical and integrity values adopted by the Company to prevent improper practices; as well as the adherence to all guidelines and policies established in the Manual of Ethical Values, Integrity and Code of Conduct and the encouragement of an ethical culture within the organization to create a better environment and organizational climate.

Sustainability

Committee

Body responsible for the adoption and monitoring of the comprehensive sustainable strategy, made up of the highest level of government of the organization, ensuring compliance with the 2030 Agenda.

Other Governing

Bodies

At Grupo Financiero B×+ we maintain active other governance bodies, comprised by Board members and/or directors with several responsibilities, such as: Assets and Liabilities, Acquisitions, Credits, Investments, Transformation, Communication and Control, Business Continuity, among others.

Remuneration

System

In compliance with the rules established by the National Banking and Securities Commission through the General Provisions Applicable to Credit Institutions, we have a robust Compensation System within the established framework, which is available at www.vepormas.com in the Investor Relations section.

Consolidated Financial Statements

Grupo Financiero B×+

Informe de los auditores independientes

al Consejo de Administración y Accionistas

de Grupo Financiero Ve por Más, S.A. de C.V. y Subsidiarias

Opinión

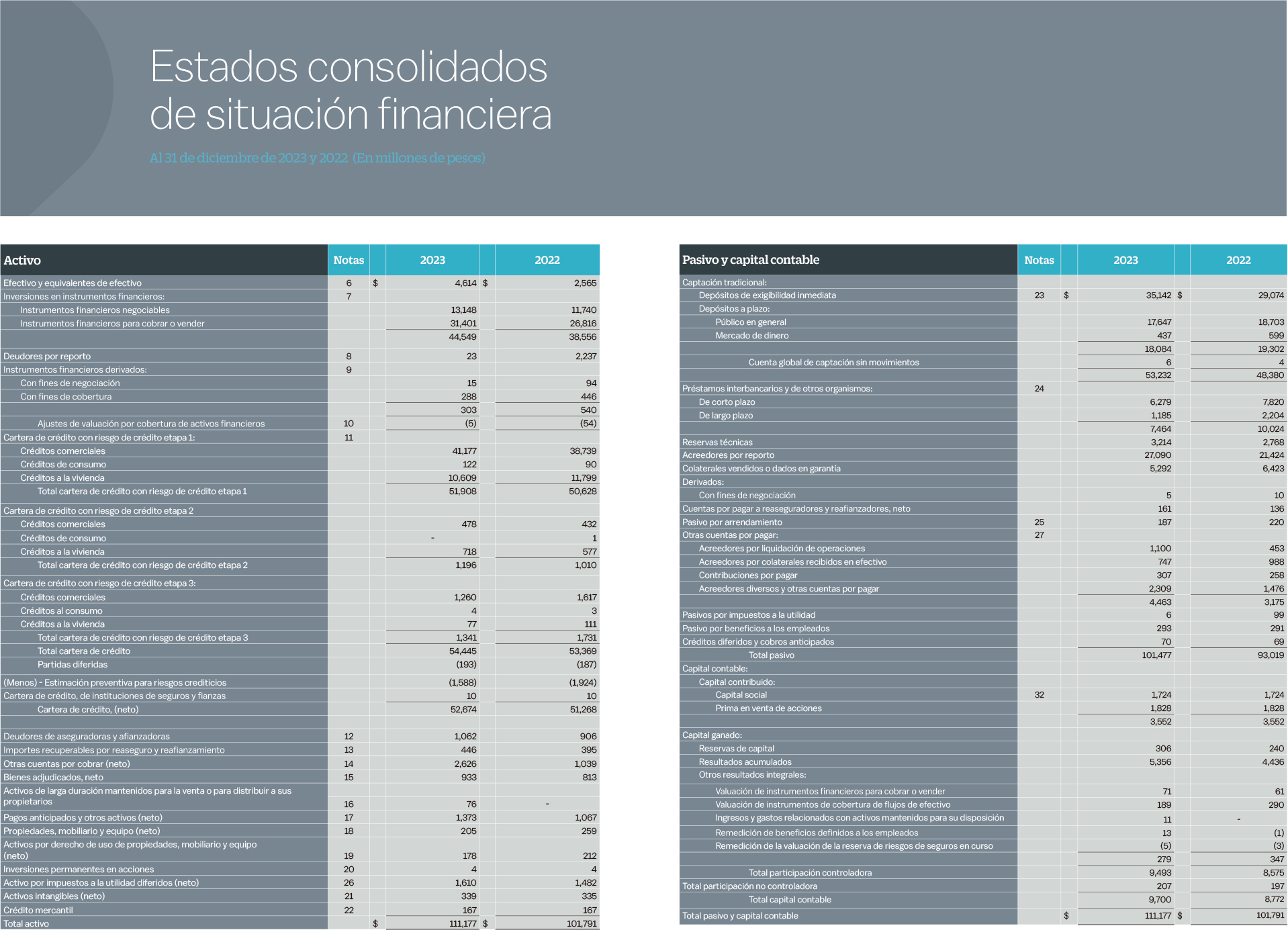

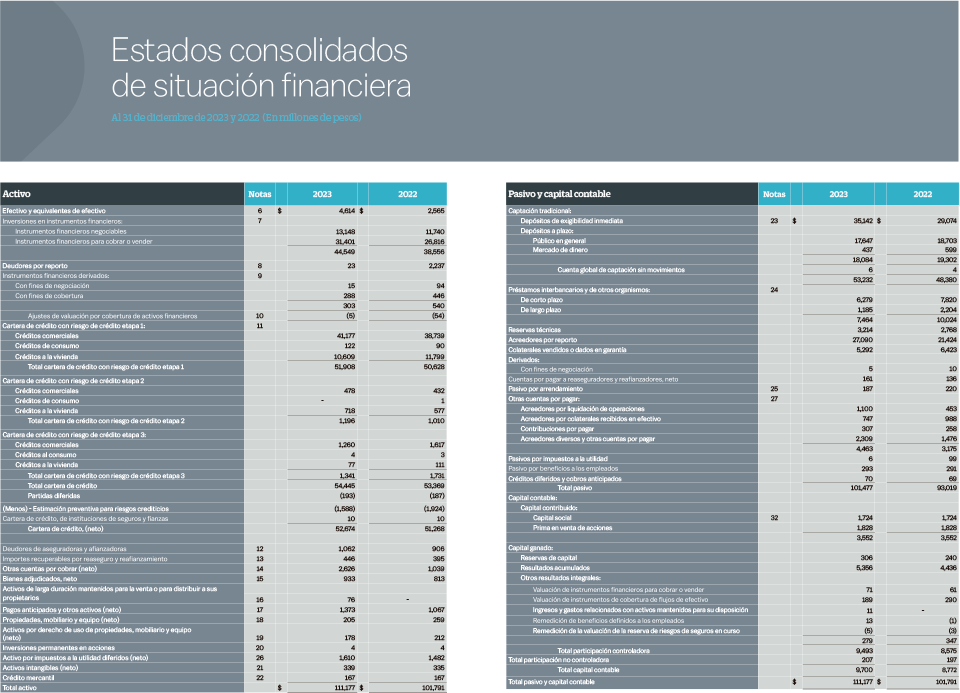

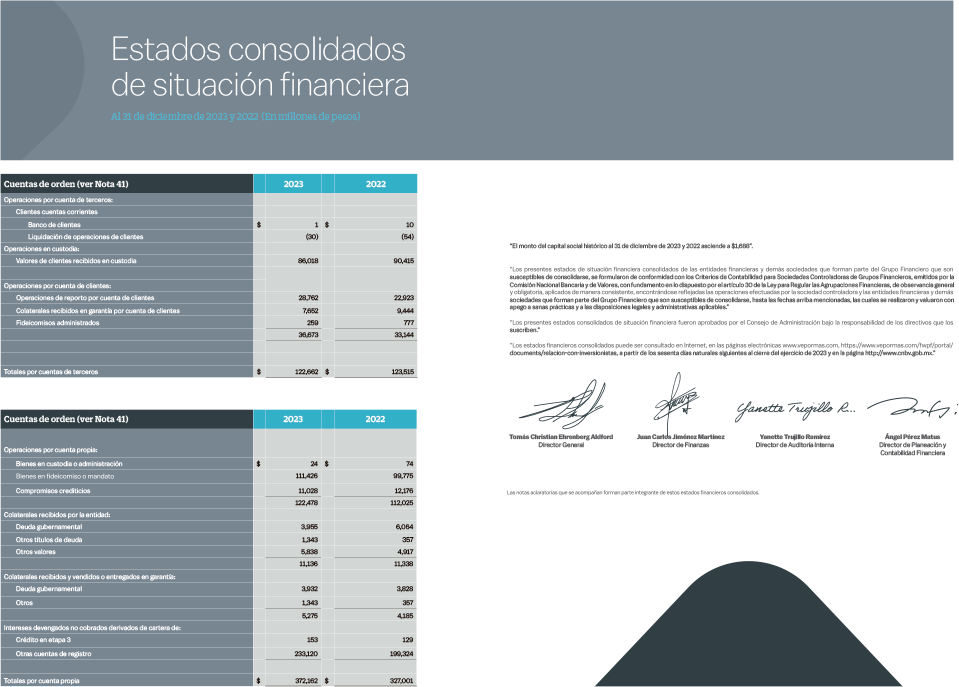

Hemos auditado los estados financieros consolidados de Grupo Financiero Ve por Más, S.A. de C.V. y Subsidiarias (el “Grupo Financiero”), que comprenden los estados consolidados de situación financiera al 31 de diciembre de 2023 y 2022, los estados consolidados de resultados integrales, de cambios en el capital contable y de flujos de efectivo correspondientes a los años que terminaron en esas fechas, así como las notas explicativas a los estados financieros consolidados que incluyen un resumen de las políticas contables significativas.

En nuestra opinión, los estados financieros consolidados adjuntos del Grupo Financiero han sido preparados, en todos los aspectos importantes, de conformidad con los Criterios Contables (los “Criterios Contables”) establecidos por la Comisión Nacional Bancaria y de Valores (la “Comisión”) a través de las Disposiciones de Carácter General Aplicables a las Sociedades Controladoras de Grupos Financieros, Instituciones de Crédito, Casas de Bolsa, Sociedades Financieras de Objeto Múltiple Reguladas y en la Circular Única de Seguros y Fianzas (las “Disposiciones”).

Fundamentos de la opinión

Llevamos a cabo nuestra auditoría de conformidad con las Normas Internacionales de Auditoría (“NIA”). Nuestras responsabilidades bajo esas normas se explican más ampliamente en la sección de Responsabilidades de los auditores independientes en relación con la auditoría de los estados financieros consolidados de nuestro informe. Somos independientes del Grupo Financiero de conformidad con el Código de Ética para Profesionales de la Contabilidad del Consejo de Normas Internacionales de Ética para Contadores (“Código de Ética del IESBA”) y con el emitido por el Instituto Mexicano de Contadores Públicos (“Código de Ética del IMCP”), y hemos cumplido las demás responsabilidades de ética de conformidad con el Código de Ética del IESBA y con el Código de Ética del IMCP. Consideramos que la evidencia de auditoría que hemos obtenido proporciona una base suficiente y adecuada para nuestra opinión.

Otros asuntos

Los estados financieros consolidados adjuntos, en donde se precisa, presentan información financiera no auditada dentro de sus Notas, la cual es requerida en las Disposiciones establecidas por la Comisión.

Cuestiones clave de la auditoría

Las cuestiones clave de auditoría son aquellas cuestiones que, según nuestro juicio profesional, han sido de la mayor significatividad en nuestra auditoría de los estados financieros del período actual. Estas cuestiones han sido tratadas en el contexto de nuestra auditoría de los estados financieros en su conjunto y en la formación de nuestra opinión sobre estos, y no expresamos una opinión por separado sobre esas cuestiones.

Hemos determinado que las cuestiones que se describen a continuación son las cuestiones clave de auditoría que se deben comunicar en nuestro informe.

Valuación de Instrumentos Financieros (Véanse las Notas 4, 7, 9 y 31 a los estados financieros)

La valuación de los instrumentos financieros del Grupo Financiero se consideró como un área clave de enfoque de nuestra auditoría debido a que su proceso de valuación requiere que, aplicando el juicio profesional, la Administración determine su modelo de negocio, así como los factores cuantitativos y cualitativos que para determinar el nivel de jerarquía y el valor razonable de los mismos.

En la Nota 4 a los estados financieros adjuntos, la Administración ha descrito las principales políticas aplicadas para la determinación de la valuación de los instrumentos financieros.

Nuestros procedimientos de auditoría incluyeron lo siguiente:

1. Obtuvimos por parte de la Administración el modelo de negocio aplicable a los diferentes tipos de instrumentos financieros. Con base en una muestra, revisamos que los instrumentos financieros se encontrarán razonablemente clasificados en los estados mismos.

2. Llevamos a cabo la evaluación del diseño e implementación de los controles relevantes, así como la revisión de la eficacia operativa de los mismos.

3. Revisamos al 31 de diciembre de 2023, la reconciliación que llevó a cabo la administración de las bases de instrumentos financieros extraídas de los sistemas operativos contra los saldos contables, observando también su razonable agrupación y clasificación.

4. Para los instrumentos financieros bursátiles, obtuvimos una confirmación al 31 de diciembre de S.D. Indeval Institución para el Depósito de Valores, S.A. de C.V. y de Valuación Operativa y Referencias de Mercado S.A. de C.V. respecto de la posición de valores que mantenía el Grupo Financiero a esa fecha y a su valor de mercado de conformidad con las Disposiciones.

5. Con base en una muestra de los instrumentos financieros derivados de negociación y de cobertura, obtuvimos las cartas confirmación que la contraparte envía al Grupo Financiero al momento de celebrar la operación, y cotejamos que la información fuera consistente con la contenida en el sistema operativo.

6. Con base en una muestra recalculamos el valor de los instrumentos financieros con nivel de jerarquía 1 y 2. Al 31 de diciembre de 2023 el Grupo Financiero no cuenta con instrumentos financieros con nivel de jerarquía 3. Para los instrumentos financieros derivados involucramos a nuestro equipo de especialistas. Este trabajo incluyó el cálculo de la valuación al 30 de septiembre de 2023 sobre una muestra de instrumentos financieros derivados con el uso de variables independientes y en algunos casos resultaron en valuaciones diferentes a las calculadas por la Administración del Grupo Financiero, observando que las diferencias se encontraban dentro de rangos razonables. Llevamos a cabo procedimientos analíticos sobre la muestra de septiembre para observar si su saldo al 31 de diciembre de 2023 era razonable.

8. Nuestro equipo de especialistas también revisó el cumplimiento de los requisitos que establecen los Criterios Contables para designar a los instrumentos financieros derivados como de cobertura.

Los resultados de nuestros procedimientos de auditoría fueron razonables.

Estimación preventiva para riesgos crediticios (véase la Nota 4 y 11 a los estados financieros)

El Grupo Financiero constituye la estimación preventiva para riesgos crediticios de su cartera de crédito, con base en las reglas de calificación de cartera establecidas en los Criterios Contables, los cuales establecen metodologías de evaluación y constitución de reservas por tipo de crédito. La elaboración de dicha metodología requiere que, aplicando el juicio profesional, la Administración determine los factores cuantitativos y cualitativos que se aplicarán para la determinación de la probabilidad de incumplimiento, severidad de la pérdida y exposición al incumplimiento de los créditos. La determinación de la estimación preventiva se ha considerado un asunto clave de la auditoría debido a la importancia de la integridad y exactitud de la información utilizada en su determinación; así como la correcta aplicación de la metodología establecida por la Comisión para determinar el cálculo de la estimación.

En la Nota 4 a los estados financieros adjuntos, la Administración ha descrito las principales políticas aplicadas para la determinación de la estimación preventiva para riesgos crediticios.

Nuestras pruebas de auditoría comprendieron una combinación de pruebas de controles y pruebas sustantivas sobre saldos y transacciones:

1. Realizamos un recorrido de control interno para identificar los controles establecidos por la Administración para la adecuada integración de la información de los expedientes de crédito durante los procesos de alta de los créditos y su administración. Una vez identificados los controles clave probamos el diseño e implementación de dichos controles.

2. Involucramos a nuestro equipo de especialistas para la revisión de la clasificación en etapas de la cartera de crédito.

3. Sobre una muestra de expedientes revisamos que la carga de los insumos utilizados en el motor de cálculo de la estimación preventiva para riesgos crediticios fuera íntegra y exacta.

4. Probamos el diseño e implementación de los controles relevantes de tipo revisión implementados por la Administración sobre la razonabilidad de los resultados del cálculo de la estimación preventiva para riesgos crediticios.

5. Involucramos a nuestros especialistas en modelos de reservas con el objetivo de verificar la aplicación del modelo y los parámetros de cálculo establecidos por la Comisión a través del recálculo de la estimación preventiva para riesgos crediticios de la totalidad de la cartera al 30 de septiembre de 2023.

6. Revisamos la integridad de la información comprobando que el total de la cartera crediticia estuvo sujeto al cálculo de la estimación preventiva para riesgos crediticios.

7. Adicionalmente, al 31 de diciembre de 2023 como prueba analítica sustantiva realizamos una expectativa del saldo de la estimación preventiva para riesgos crediticios a esa fecha con base en el comportamiento de la cartera de crédito.

Los resultados de nuestros procedimientos de auditoría fueron razonables

Responsabilidades de la Administración y de los responsables de gobierno corporativo del Grupo Financiero en relación con los estados financieros consolidados

La Administración del Grupo Financiero es responsable de la preparación y presentación de los estados financieros consolidados adjuntos de conformidad con los Criterios Contables, y del control interno que la Administración considere necesario para permitir la preparación de los estados financieros consolidados libres de error material, debido a fraude o error.

En la preparación de los estados financieros consolidados, la Administración es responsable de la evaluación de la capacidad del Grupo Financiero de continuar como empresa en funcionamiento, revelando, según corresponda, las cuestiones relacionadas con el Grupo Financiero en funcionamiento y utilizando el principio contable de empresa en funcionamiento, excepto si la Administración tiene la intención de liquidar Grupo Financiero o detener sus operaciones, o bien no exista otra alternativa realista.

Los encargados de gobierno del Grupo Financiero son responsables de la supervisión del proceso de información financiera del Grupo Financiero.

Responsabilidades de los auditores en relación con la auditoría de los estados financieros consolidados

Nuestros objetivos son obtener una seguridad razonable de que los estados financieros consolidados en su conjunto están libres de errores materiales, debido a fraude o error, y emitir un informe de auditoría que contiene nuestra opinión. Seguridad razonable es un alto nivel de seguridad, pero no garantiza que una auditoría realizada de conformidad con las NIA siempre detecte un error material cuando existe. Los errores pueden deberse a fraude o error y se consideran materiales si, individualmente o de forma agregada, puede preverse razonablemente que influyen en las decisiones económicas que los usuarios toman basándose en los estados financieros consolidados.

Como parte de una auditoría ejecutada de conformidad con las NIA, ejercemos nuestro juicio profesional y mantenemos una actitud de escepticismo profesional durante toda la auditoría. Nosotros también:

Identificamos y evaluamos los riesgos de incorrección material de los estados financieros consolidados, debida a fraude o error, diseñamos y aplicamos procedimientos de auditoría para responder a dichos riesgos y obtuvimos evidencia de auditoría que es suficiente y apropiada para proporcionar las bases para nuestra opinión. El riesgo de no detectar una incorrección material debida a fraude es más elevado que en el caso de una incorrección material debido a un error, ya que el fraude puede implicar colusión, falsificación, omisiones deliberadas, manifestaciones intencionalmente erróneas o la elusión del control interno.

Obtenemos conocimiento del control interno relevante para la auditoría, con el fin de diseñar procedimientos de auditoría que sean adecuados en función de las circunstancias y no con el fin de expresar una opinión sobre la efectividad del control interno del Grupo Financiero.

Evaluamos lo adecuado de las políticas contables aplicadas y la razonabilidad de las estimaciones contables y la correspondiente información revelada por la Administración.

Concluimos sobre lo adecuado de la utilización por la Administración, de la norma contable de empresa en funcionamiento y, basándonos en la evidencia de auditoría obtenida, concluimos sobre si existe o no una incertidumbre material relacionada con hechos o condiciones que pueden generar dudas significativas sobre la capacidad del Grupo Financiero para continuar como empresa en funcionamiento. Si concluimos que existe una incertidumbre material, se requiere que llamemos la atención en nuestro informe de auditoría sobre la correspondiente información revelada en los estados financieros consolidados o, si dichas revelaciones no son adecuadas, que expresemos una opinión modificada. Nuestras conclusiones se basan en la evidencia de auditoría obtenida hasta la fecha de nuestro informe de auditoría. Sin embargo, hechos o condiciones futuros pueden ser causa de que el Grupo Financiero deje de ser una empresa en funcionamiento.

Obtenemos evidencia suficiente y adecuada en relación con la información financiera de las entidades o actividades empresariales dentro del Grupo Financiero para expresar una opinión sobre los estados financieros consolidados. Somos responsables de la dirección, supervisión y realización de la auditoría del Grupo Financiero. Somos los únicos responsables de nuestra opinión de auditoría.

Comunicamos a los responsables del gobierno del Grupo Financiero en relación con, entre otras cuestiones, el alcance y el momento de la realización de la auditoría y los hallazgos significativos de la auditoría, así como cualquier deficiencia significativa en el control interno que identificamos en el transcurso de la auditoría.

También proporcionamos a los responsables del gobierno del Grupo Financiero, una declaración de que hemos cumplido con los requerimientos de ética aplicables en relación con la independencia y les hemos comunicado acerca de todas las relaciones y demás cuestiones de las que se puede esperar razonablemente que pueden afectar nuestra independencia, y en su caso, las correspondientes salvaguardas.

Entre las cuestiones que han sido objeto de comunicaciones con los responsables de gobierno del Grupo Financiero, determinamos que han sido de la mayor significatividad en la auditoría de los estados financieros consolidados de los ejercicios 2023 y 2022 y que son en consecuencia, las cuestiones clave de la auditoría. Describimos esas cuestiones en este informe de auditoría, salvo que las disposiciones legales o reglamentarias prohíban revelar públicamente la cuestión o, en circunstancias extremadamente poco frecuentes determinemos que una cuestión no se debería comunicar en nuestro informe porque cabe razonablemente esperar que las consecuencias adversas de hacerlo superarían los beneficios de interés público de la misma.

Placements

The information contained in the present report was obtained from sources considered reliable, which contain approaches and data in estimates. They are also based on current views and opinions about the future of our management.

The results expressed in statements based on estimates and are subject to possible changes, among others: variations in general economic conditions, government policies, commercial and financial at a global level and in Mexico, as well as changes in interest rates, inflation levels, exchange rates and commercial strategy.

Grupo Financiero B×+ does not intend to update these forward-looking statements and assumes no obligation to do so. The information contained in this document should not be used to make business or investment decisions of any kind.

Contact

B×+ Financial Group

Paseo de la Reforma 243, 21st floor,

Col. Cuauhtémoc, Alcaldía Cuauhtémoc,

C.P. 06500, Mexico City.

Tel. 55 1102 1800

Call within México 800 8376 762